If you're shipping packages to countries that follow European Union (EU) customs rules, there are new customs regulations you'll need to follow. If you don't provide more-detailed content descriptions on your customs forms, your packages may be returned or refused. USPS is providing tools to help shippers comply with these new rules.

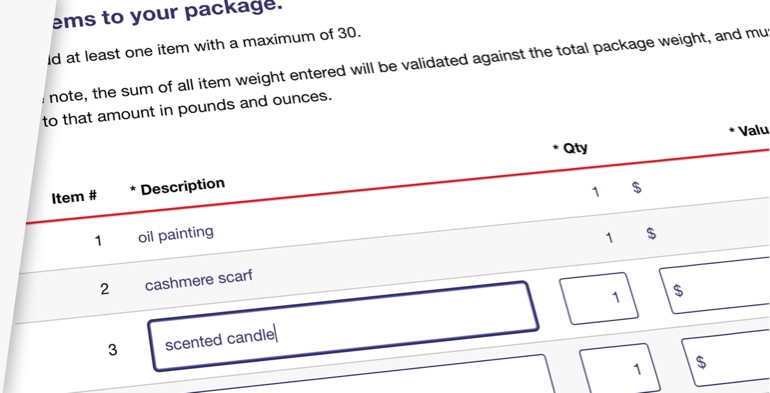

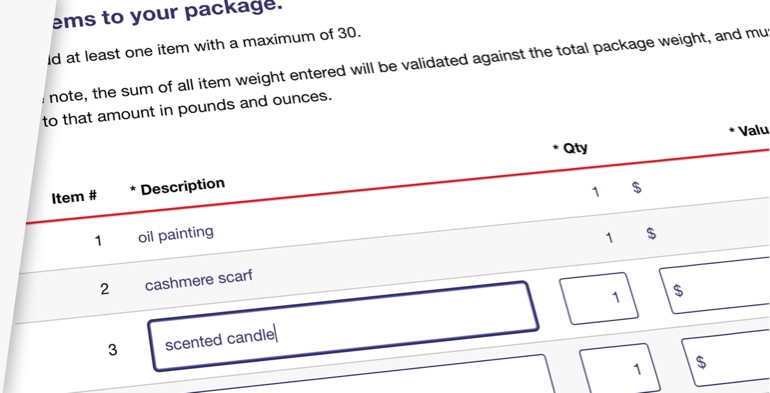

| Unacceptable | Acceptable |

|---|---|

| Clothes | Men's shirts, girls' vest, boys' jackets |

| Appliances | Refrigerator, stove, microwave oven |

| Artwork | Oil painting, pencil sketch, bronze statue |

| Battery | Lithium batteries |

| Gifts | Scented candle, remote-controlled car, cashmere scarf |

| Medicine | Painkillers, antiviral spray |

| Health & Beauty Products | Detergent, toothbrush, towels |

| Vegetables | Eggplant, onions, broccoli |

Outbound U.S. shippers send tens of millions of packages to EU countries each year. However, if you don't comply with new requirements in EU customs rules, your shipments will be at risk. Don't jeopardize your packages, revenue, and customer satisfaction!

As of July 2021, all shipments to EU member states require formal customs declarations and are subject to Value-Added Tax (VAT). To ensure uninterrupted customs processing and delivery, formal customs declarations must be completed accurately, including a comprehensive description of goods for each item in the shipment. Detailed instructions are outlined below.

Do not use any abbreviations.

Do not use any abbreviations.

You must include a specific, accurate description for each item in your shipment. For example, if you are sending electronics, you must indicate what type of electronics (e.g., television, computer, mobile phone) for the description to be acceptable.

You must include a separate and specific value for all items in your shipment. Once calculated, included a total value for the shipment.

You must include the total gross weight of the package and the unit of calculation (i.e., pounds or kilograms).

HS Tariff Codes are identifiers linked to specific goods descriptions. Once you have accurately described the item you are shipping, USPS will provide an HS Code for your customs form. In the event that you cannot find an HS Tariff Code, an accurate goods description is enough for customs processing.

Harmonized System Codes are very complex. You can learn more about HS codes here.

The Harmonized Commodity Description and Coding System generally referred to as "Harmonized System" or "HS" is a multipurpose international product nomenclature developed by the World Customs Organization (WCO). The system categorizes commodity groups by six-digit codes, creating a universal economic language for the shipping of goods. These codes are used for internal taxes, trade policies, monitoring of controlled goods, rules of origin, freight tariffs, transport statistics, price monitoring, quota controls, compilation of national accounts, and economic research and analysis. The WCO updates the HS every 5 years. 1

Countries often add additional digits to the end of the six-digit code to further classify products. The United States uses a 10-digit code to classify products. 2

It is recognized that many of the challenges faced by the HS are inherent and unavoidable in any multipurpose international commodity classification.

by customer after being sucessfully delivered." />

by customer after being sucessfully delivered." />

A solution tailored to small and medium businesses in select markets: USPS Connect ™ Local Mail lets you offer your local customers affordable, same-day/next-day delivery for envelopes and flats (large envelopes) up to 13 oz. You'll get a special flat-rate price for taking your mail to a USPS ® drop-off point close to your customer.

by customer after being sucessfully delivered." />

by customer after being sucessfully delivered." />

If you're a business shipping larger batches of packages (50 or 200 at a time, depending on service) to customers in the same region, USPS Connect ™ Regional can help you reach customers with next-day shipping. You'll get special rates and expedited handling for meeting package minimums, pre-sorting packages, and taking them to designated USPS ® facilities close to your customers.